This story originally appeared in the inaugural edition of the Owensboro Times quarterly newspaper.

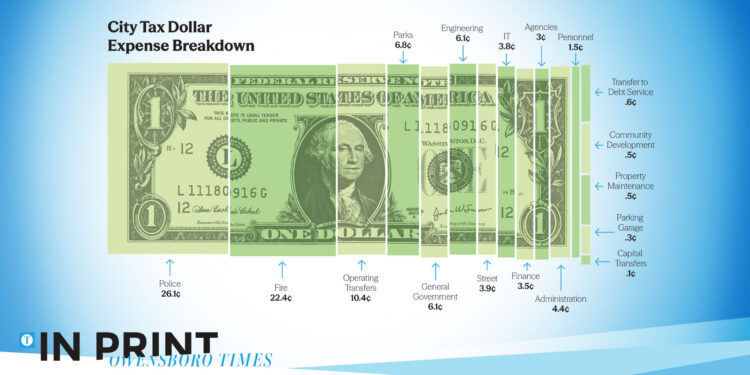

For every tax dollar collected by the City of Owensboro, the largest portions go toward public safety, with the police and fire departments accounting for nearly half of the city’s tax revenue allocation. However, the breakdown strictly represents tax revenue distribution and does not include other sources of funding, such as program fees and external grants.

Public safety accounts for nearly half of spending

The largest share of tax revenue is allocated to the police and fire departments, which together receive nearly 49 cents of every tax dollar. According to Finance & Support Services Director Angela Waninger, salaries and benefits make up about 83% of the fire department’s expenses and 82% of the police department’s. The remaining funds cover operational costs such as fuel, repairs, uniforms, capital replacements, and other essential needs.

Parks as a community investment

Owensboro takes pride in its parks and recreational facilities, dedicating 6.8 cents per tax dollar to park services. These funds support the management and maintenance of 960 acres of parkland, including 25 parks, two swimming pools, 38 tennis courts, four pickleball courts, two golf courses, a sports arena, and an ice arena.

While parks generate revenue through facility rentals and programs, Waninger said the department is subsidized by the general fund. She said parks are designed for public good and recreation, contributing to community value and environmental health, rather than an endeavor to generate profit.

Fiscal responsibility and cost-saving initiatives

Waninger said city officials and department leaders work together to ensure tax dollars are spent efficiently. She said Owensboro boasts the lowest expenditure per capita in the state at $1,664, compared to Paducah’s $2,484. Recent cost-saving measures include transitioning to electronic payments (ACH) instead of paper checks, reducing labor, paper, and mailing costs. Additionally, competitive bidding is used for services that do not legally require a bid, allowing the city to secure lower prices through market competition.

Waninger emphasized that Owensboro’s budget is crafted with input from elected officials, department directors, and residents to reflect the city’s needs and priorities. She said every tax dollar is allocated with the goal of maximizing community benefits while maintaining fiscal responsibility and transparency.

Capital transfers and infrastructure investments

The city allocates 0.1% ($100,000) of its general fund to capital transfers, which support small-scale capital projects. Every expenditure undergoes careful review, with priority given to projects that provide the most benefit to Owensboro residents.