The Kentucky Senate has introduced a tax rebate plan in Senate Bill 194 that could allow taxpayers to receive a $500 rebate, saying the legislation is in direct response to high inflation.

Under the Senate’s plan, unveiled Thursday morning during a special Appropriations and Revenue Committee, each working Kentucky taxpayer will receive up to $500 and a maximum of $1,000 per household.

If filers paid less than $500 individually or $1,000 per household, they would receive a rebate of the lower amount. If the filer paid no state taxes, they would not receive a rebate.

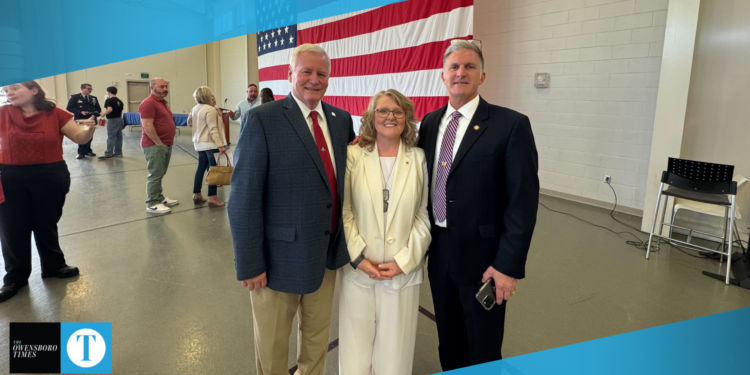

“In light of the highest rate of inflation (7.5 percent) our country has seen in 40 years, the Senate is taking action to provide some relief to working Kentucky taxpayers,” said Senator Matt Castlen (R-Owensboro). “The bill will provide up to a $500 tax rebate for individuals and up to $1,000 for households. Kentucky revenues are up, and the right thing to do now is put money back into the pockets of our hardworking taxpayers. We’re focused on doing the right thing and giving our citizens what they have earned.”

According to an email from Castlen about the plan, “This tax rebate is possible because of the conservative budgeting of the commonwealth; unexpected and exceptional revenue growth is expected to yield over $1.94 billion in excess funds that belong to Kentucky taxpayers.”

Senator Chris McDaniel (R-Taylor Mill), the chairman of the committee as well as the chief sponsor of SB 194, said “As our nation is experiencing the highest inflation in 40 years, it’s important that lawmakers respond in a way that helps ease the burden on taxpaying Kentuckians.”